Your pension benefit is made up of two components, your lifetime pension and your bridge benefit. Your lifetime pension is payable for life. It is calculated at:

- 5.0% for service prior to October 2013, and

- 3.5% for service after September 2013 prior to the election held in May 2017.

This applies to both your annual indemnity and your highest average Additional Salary (Executive Council).

For service after the May 2017 election, your lifetime pension is calculated at:

- 2.8% up to the average YMPE* during the 3 years in which your annual indemnity was its highest, plus

- 3.5% on the portion of your average annual indemnity during that same period, plus

- 3.5% on your highest average Additional Salary (Executive Council).

Your bridge benefit is payable until age 65 and it is calculated at 0.7% for service after the May 2017 election, up to the average YMPE during the 3 years in which your annual indemnity was its highest.

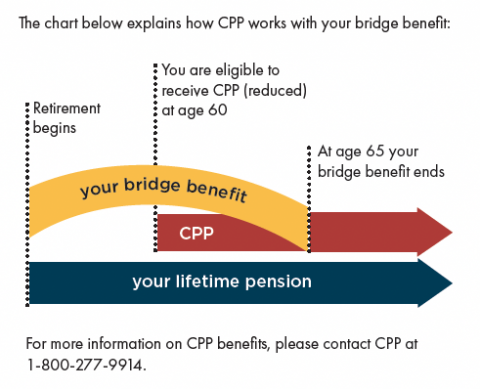

Your bridge benefit is payable from the date you start receiving your pension until age 65. The bridge benefit is designed to supplement your income until unreduced benefits are payable from the Canada Pension Plan (CPP) at age 65. A reduced CPP may be drawn as early as age 60.

NOTE: If you retire before age 65 and decide to begin receiving a reduced CPP benefit, you will still receive the bridge benefit until age 65.

*The YMPE (Year’s Maximum Pensionable Earnings) is an important term to understand when it comes to calculating your pension contributions. It is set by the federal government and is used in determining the reduction to your pension at age 65. It changes every January 1 to reflect increases in the average wage.